INTRODUCTION

Avalanche is a platform for creating dapps and other blockchains that's why some people called them a a layer zero project. Because they can run other blockchains on top. This makes Avalanche similar to Interoperability projects like polkadot or cosmos. But because they also have their own dapps and defi protocols they can also compete with layer one protocols like Ethereum and Solana.

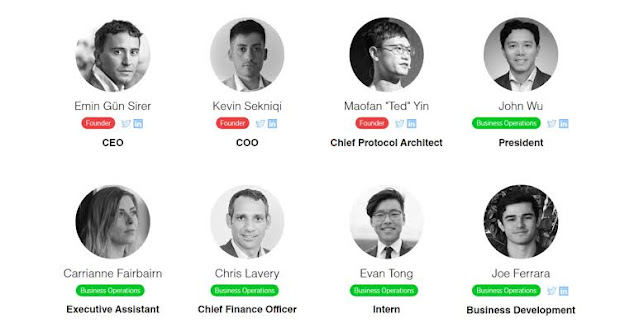

#1 LONG TERM TEAM

Avalanche Team consists of some of the best developers and researchers in the world hailing from Google, Microsoft, NASA mem squad, and some of them even won an international programming compitition before. Headquartered is in Singapore, Avalanche’s Ava Labs has offices in New York City and Miami.

#2 KEY DIFFERENCE

One key difference is that Avalanche itself consists of three different chains. Their X-chain manages token on their network, the P-chain manages validators and subnets and their C-chain manages and executes smart contracts.

Avalanche is actually considered a network of subnets which is kind of like Polkadot's parachains model where you have a lot of custom chains connected to the main network.

Avalanche's architecture is flexible so each if their subnets can be optimised for its own purpose like you can use a different consensus mechanism. A different virtual machine or even make it permissioned instead of public. They also created their own Avalanche virtual machine which lets subnets use a traditional blockchain or a dag like structure.

As you might have expected Avalanche is blazing fast, they can support over a 4,500 transactions per second per subnet with most transactions getting finalized in under 1 sec. They accomplished this with their novel consensus protocol called Avalanche consensus and snowman consensus.

I won't go too deep here but they use randomized subsample voting and gossip protocols to make things fast and scalable and secure. Avalanche consensus also supports a large number of validators so everyone can validate assuming they meet the other requirements. Native token is Avax and it has a fixed supply which is quite different from other proof-of-stake network. It serves as a unit of account, is used to pay transaction fees and you need to stake it to become a validator.

#3 GOOD ARCHITECTURE

Because their system design brings about several key benefits like their hub and spoke model between the core Avalanche network, and all their subnets is super flexible. Subnets can be customised in more ways than you can imagine and they don't have to share security guarantees. That means if one subnet fails for whatever reasons it won't negatively affect the security of other ones. They also made their C-chain EVM compatible right out of the gate which I think was the smart design because this lets builder port over ethereum apps quickly as compared to cosmos or polkadot. Those two also supports EVM but honestly their implementation are rough around the edges.

And I think the big reason why is because they didn't focus on it from the beginning like Avalanche did. Avalanche's decision also make it incredibly resilient to attack. In fact you would need upto 81% of the validators slash stake in order to successfully attack the network. Whereas for other coins 51% is generally enough.

This is because Avalanche nodes are queried randomly so in order to gossip your way to 51% attack you need to control way more than 51%. For that to be realistic and various parameters can also be tweaked to get that safety threshold. Upto 81% like the number of query rounds to do. The sample size, the acceptance threshold, and things like that.

And the last thing I like about Avalanche's architecture is that they make it really enticing to be a validator. Yes I know there's a large minimum stake but assuming you have that anyone can be a validator. It's not capped at some numbers, and huge benefit for validators is that subnets can issue their own coins as incentives. So I can see people in the future buying Avax just to farm all those rewards.

#4 IMPRESSIVE ADOPTION

Just look at the chart of their total addresses count or this one their cumulative transaction count both are rocket ship up and to the right. They have also burned over 1.7M Avax since launch.

Avalanche currently ranks three overall in terms of total value locked with over $7.93B locked that number is rising quickly though with over $2.6B worth of assets bridge over from Ethereum so far.

This is likely because of their massive DeFi incentive program called Avalanche Rush. They had started with two blue chip protocols, Aave and Curve, and are offering tons of Avax tokens for anyone who provides liquidity to them. So that's why a lot of people are bringing over for those juicy rewards.

And lastly,

#5 GOOD TOKENOMICS

Unlike most other proof-of-stake chains, Avalanche has a fixed hard cap. This makes them like bitcoin a sense but Avalanche also burns transaction fees. So that's a source of deflationary pressure as well. That's why their total supply chart looks something like this.

And honestly that's make Avax more like ultrasound money than any other proof-of-stake I have seen.

Conclusion

Avalanche is here to stay and dominate the entire blockchain space. Avalanche is undisputed tech giant with its unshakeable cool features, and best developers and researchers around the world which only helps Avalanche to grow in long term. This is the reason why I am still bullish on $AVAX irrespective of current scenario. What else do you need to get on the board?